Westshore Office Portfolio

Tampa, FL

Acquired $66,000,000 – 4-year hold – Sold $89,250,000

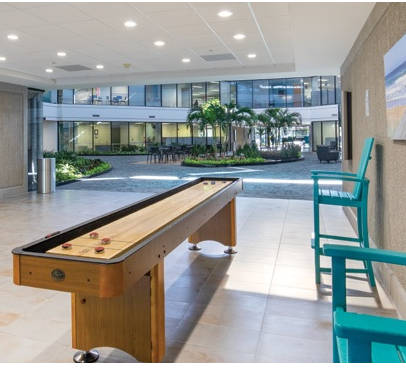

Property & Opportunity

Commercial Florida Realty Partners acquired the Westshore Office Portfolio (Westshore) in 2015. The portfolio included 4 office buildings totaling in 460,460 RSF, parking structures and 5.5 acres of developable raw land. Properties are mid to late 1980’s vintage and offer a variety of tenant amenities. Building details are as follows,

- Westshore Corporate Center – Class A, 173,546 SF, 12 stories

- Cypress Center I – Class B, 153,634 SF, 3 stories

- Cypress Center II – Class B, 49,935 SF, 2 stories

- Cypress Center III – Class B, 83,345 SF, 3 stories

- Cypress Center IV – Proposed-Class A, 200,000 SF, 6 stories